Business Need

The Middle Eastern bank was using an on-premise version of Microsoft Dynamics CRM to manage their growing customer base. Over time, they found the need to enable an array of customizations to support business needs based on their finance domain. They also wanted to enable integration with several third-party trading and wealth management systems to improve operational efficiency as well as the products and services they were offering to their customers.

As Synoptek has been supporting their on-prem Dynamics CRM system for almost 4 years, the bank engaged with us again to carry out customization, portal work, as well as third-party app integrations along with several data import tasks.

Solution and Approach

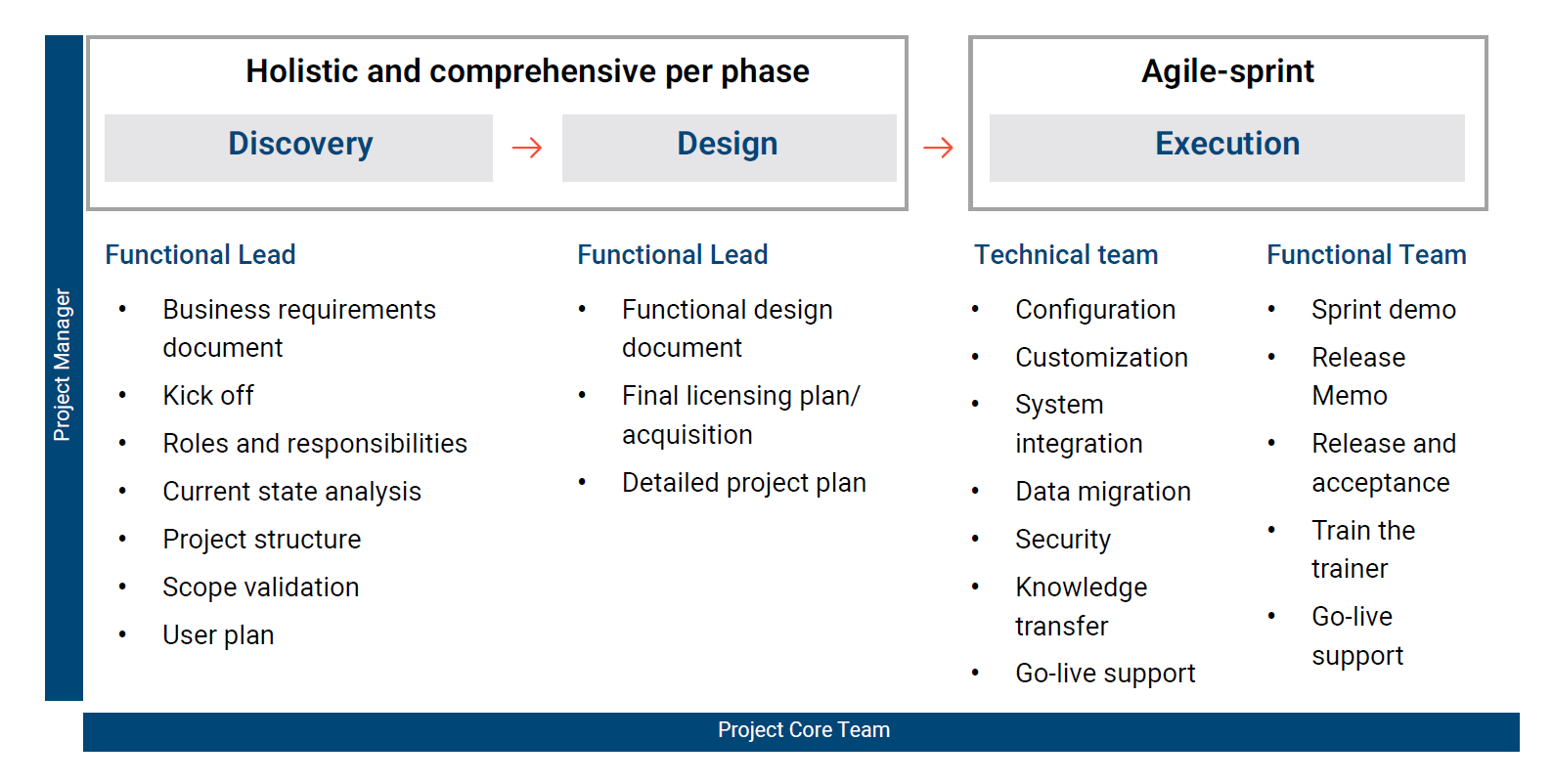

Synoptek established a qualified project team to conduct a thorough discovery of the client’s current processes and requirements, carry out a detailed scope validation, and design a detailed project plan for execution.

As a Microsoft Gold Partner, Synoptek delivered a bunch of Microsoft Dynamics CRM enhancements, customizations, customer portal implementation, and multiple third-party integrations as requested by the client team.

Business process enhancements

- Enabled several KYC and business process enhancements for better data capture.

- Implemented improvements to existing data import automation feature for Smart Wealth, Pershing, and Funds Admin.

- Captured additional information for tracking and monitoring Profile Change Requests in compliance with regulatory rules.

- Synced bank accounts between Profile & KYC information for better accessibility and quick verification for the purpose of compliance checks.

- Made enhancements to business processes, generated joint account notifications, and created necessary data structure for upcoming Pershing integration project.

- Implemented the concept of joint account holders in profile information and ensured appropriate linking of information for correct referencing, thus avoiding duplication of data.

- Implemented various validations based on the regulatory commitments to be met by the business team.

- Enabled auditing to track the most important data points with an ability to extract audit data for further submission.

Third-party integrations

Enabled data integration via APIs between online trading platform Mubasher and the Dynamics CRM application including:

- Customer profile

- Bank details

- Customer group

- KYC expiry date

- Risk category

- Financial advisor information

Enabled integration of Dynamics CRM with trading platform APX and upgraded the client to the new authentication method of the latest APX API version which enabled them to:

- Create, update, and manage portfolios in CRM

- Consume new web services using new authentication method

- Update the newly created job to integrate APX AUMs (including Pocket Portfolios AUM) in CRM

Customer portal implementation

- Developed a custom portal that is web, tablet, and mobile compatible to allow client’s customers to upload all their documents for KYC purposes.

- Enabled client department to receive alerts when KYC date is expiring and forward the same to customers for timely submission of KYC data entry.

- Created a mechanism for customers to receive a link to the portal where they can view all KYC-related details and update the information as required.

- Integrated the portal with the Microsoft Dynamics CRM system that allows authorized personnel to receive customer

- KYC details once filled and approve/reject them as necessary.

- Implemented OTP-based authentication for better security and an enhanced customer experience.

Business Results

As a growing Investment bank in the Middle East, the enhancements and integrations enabled by Synoptek have paved the way for several benefits. Today, the bank is able to:

- Enable complete and quality data capture for KYC purposes, and achieve 98% coverage and accuracy, thanks to advanced information capture and business rules in place

- Reduce manual data verification efforts by 85% due to trusted inputs procedures and enjoy 90% faster data imports through the implementation of customized data imports

- Allow customers to have easy and updated access to all their KYC details and enjoy up to 60% reduction in efforts with the introduction of the self-service portal

- Enable approvers to get real-time alerts as KYC information is entered by customers via CRM integration with the portal

- Seamlessly manage customer portfolios in the Dynamics CRM system via integrations with Mubasher and APX

- Enjoy 95% reduction in data replication and ensure better employee and customer experience via integrated systems