June 8, 2023 - by Synoptek

Amidst a highly turbulent economic environment, Private Equity (PE) firms need to wake up to the benefits of digital transformation. Embracing technology is a great way to navigate the many macroeconomic headwinds. When armed with modern digital capabilities, PE firms can make better portfolio acquisition decisions, drive increased revenue growth, and streamline everyday operations. Technology can also enable them to respond to market fluctuations with speed and accuracy and achieve a competitive edge.

Embark on a transformative journey through our three-part blog series, exploring the profound impact of technology on the Private Equity industry. From shaping the future state to addressing challenges and offering comprehensive solutions, this series has all the answers to your burning questions.

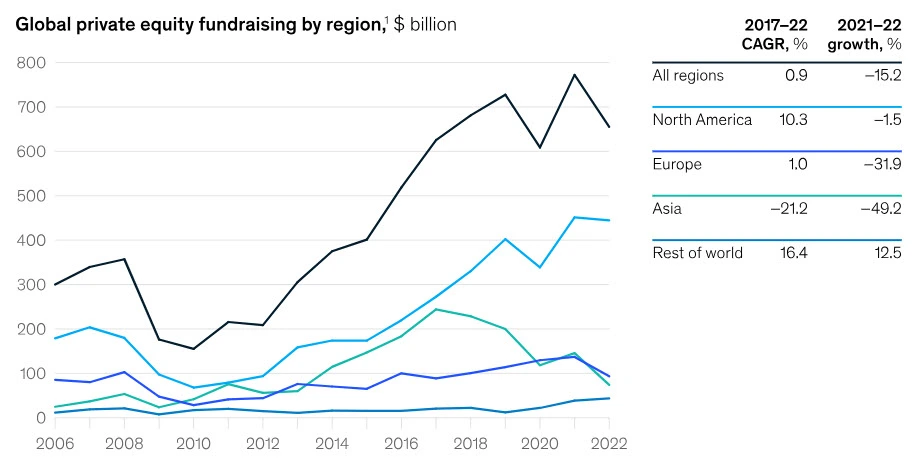

When the pandemic struck, PE firms enjoyed the many changes it brought about. Low-interest rates, high credit availability, and quick valuations made it easy for PE firms to boost their growth trajectory. But fundraising and deal flow has been tough as we move into the pre-pandemic world. According to a report by McKinsey, North America was the only region to record positive fundraising growth in 2022.

Higher costs and lower debt availability make it difficult for PE firms to stay afloat. At the same time, rapidly declining public market valuations and macroeconomic uncertainty have stifled growth, activity, and performance for many. According to the same report, global PE fundraising fell to $655 billion.

As private equity firms struggle to operate in today’s highly competitive and volatile operating environment, technology has the power to transform day-to-day functioning. Right from how operations run inside the companies to how to respond to fluctuating trends – technology can offer several ways to generate value within the investment horizons for every private equity investor.

While most PE firms today seek digital maturity in portfolio companies, they are still slow to embrace digital within their business. If you want to improve fundraising and steer the global financial crisis, you must leverage the benefits of modern technological innovations. Here are some technology trends and opportunities to embrace:

The PE landscape has been witnessing increased competition for deals. As the industry continues to be competitive in 2023 and beyond, there is immense pressure on firms to differentiate themselves and find creative ways to generate value. Implementing and exploring the use of digital automation tools can provide the edge these firms need. Automation can enable them to:

Embracing analytics is a great way for PE firms to identify opportunities in niche sectors like energy, healthcare, and e-commerce logistics. Since these sectors tend to be less crowded, private equity firms may have a better chance of exploring unique investment opportunities and achieving stronger returns. The use of analytics in the pre-and post-deal phases can help:

As Environmental, social, and governance (ESG) factors drive greater valuations, AI can help firms enable effective compliance. AI models can assist in analyzing the operating environment and capitalize on emerging trends across every step of the investment value chain. Right from strategy and fund-raising to due diligence and portfolio management, AI can help drive positive outcomes across the full spectrum of ESG considerations. Using AI, PE firms can:

The pandemic has accelerated the adoption of technology in almost every sector. In the PE industry, technology offers several capabilities to firms to identify potential investment opportunities, enter emerging markets, and enable and ensure ESG compliance.

Firms that have hopped on the digital transformation bandwagon have witnessed numerous improvements in the deal-making process. Right from increasing deal speed to better accuracy in deal pricing, improved risk assessment, automation of routine mid- and back-office manual operations, and more. However, amidst the transformative journey, challenges inevitably arise. Join us in our second blog of the three-part series as we uncover and explore the hurdles that organizations encounter on their digital transformation journey.