February 20, 2023 - by Synoptek

Organizations globally are grappling with rising prices, volatile supply chains, climate change, scarcity of talent, and more. As the ongoing repercussions of the pandemic continue to be felt, several executives paint a grim picture of the economy. Despite ongoing concerns about the global economy, enterprise technology spending is expected to remain strong, with its projection to total $4.5 trillion in 2023, an increase of 2.4% from 2022. More and more organizations are realizing the benefits of investing in digital transformation, despite the looming economic slowdown.

How can organizations navigate the ever-evolving tech landscape? How can executives prepare their organizations for their business goals in 2023 and beyond? Read on to discover how you can navigate headwinds and become competitive by taking advantage of advisory-led services.

What Does the Current Tech Services Landscape Look Like?

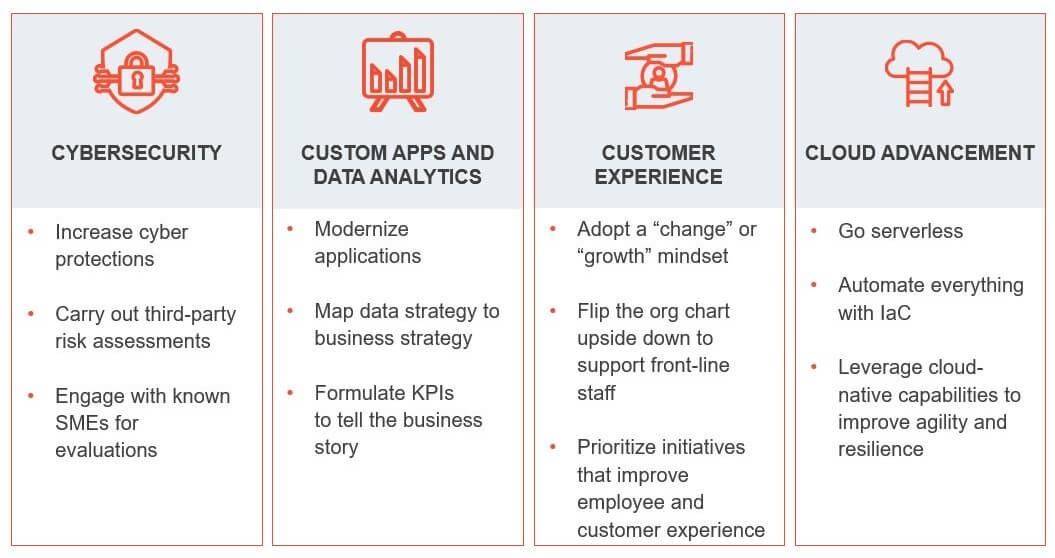

Historically, IT services have followed up and correlated with GDP. However, we’ve seen a disconnect recently. Despite declining GDP, IT spending remains resilient, like what was observed during the pandemic. In fact, organizations that doubled down on technology investments during COVID-19 are now growing five times more than the ones that didn’t. The Everest Group, which carried out a detailed study on the correlation between technology and GDP, concluded that meaningful investments in cloud advancement, data analytics, customer experience, and cybersecurity come into play today to ensure a company’s sustained growth.

What Investment Strategy Must Businesses Adopt to Succeed?

The threat of inflation looms, but budget cuts can create the exact precarious situation that companies wish to avoid. Rather than making a quick and hasty decision, a PWC survey states that executives are monitoring the possible timing and severity of the recession and are carefully planning what technological investments to make. So, which tech investments demonstrate strength and resilience? What investment strategies must businesses adopt to succeed?

Spending today is divided into two types – run spending and change spending. Run spending alone can only help maintain the existing application landscape. These short-term investments might help companies survive, but not thrive. Whereas companies that come roaring out of a recession are those that reduce costs by investing comprehensively in improving operational efficiency and modernizing their legacy systems – better known as change spending.

How to Respond to the Tech Downturn With a Long-term Strategy

Only a few companies have mastered the delicate balance between cutting costs to survive today and spending to grow tomorrow. Here are the technologies companies are adopting to smoothly sail the turbulent waters of 2023.

Custom Apps and Data Analytics

The type of spending depends on the organization and which stage they are at in their digital transformation journey. It is observed that the companies that choose the run spend only maintain their existing applications. They don’t gain a competitive advantage. Whereas having a change spend ensures the company spends most of its time/resources efficiently and achieves a higher cumulative ROI.

Another important factor is the amount of manual labor that goes into extracting and analyzing data and how setting up the right approach to data insights can deliver long-term benefits. Here’s an example to reiterate the importance of minimizing manual efforts and its direct correlation with ROI. A resort company’s CFO was manually spending 3 hours collecting data. Post automation, the CFO can extract data in 20 seconds. The value of that, multiplied by the number of employees manually collecting data in the organization, is a significant ROI.

Cloud Advancement

The major ask in today’s time is control over long-term spending and how we do more with less. Over the last 3-5 years, cloud advancement progressed and everyone started to jump into the cloud with their Dev environments and switched to the most modern applications. But now companies are coming back to hybrid cloud architecture. Along with this, for migration, there are containers that are available. Using this method, the migration of apps becomes more efficient as you don’t have to rely on operating system patching. Another emerging trend will be automating everything through code. Terraforms, for instance, will help eliminate human error throughout the software development lifecycle.

“As protecting data and resources will always be a challenge, a rise in edge computing is expected in the year 2023.”

|

Cybersecurity

Investing in cybersecurity services can also reap substantial benefits for enterprises in today’s volatile era. With cybersecurity insurance becoming more popular, security is more determined than before. But many companies fear that their insurance providers will cancel their policy because they haven’t implemented security protections like MFA. While businesses stand on both the run and change side, they’re really being driven by that immense cybersecurity insurance load.

When it comes to third-party risk management, organizations need to understand what third parties have access to and what data and services they supply from a compliance standpoint. A lot of risks exist, but the question is how fast organizations can tackle those challenges and pivot. It is here where SMEs come in to help the organization through what will be the future.

Customer Experience

As organizations get multiple partners, platforms, and systems, it becomes difficult to, understand key business drivers. Many have great technology and great employees, but the problem is, they don’t know how to function collaboratively. This is where core customer experience services capabilities come into play and provide a lot of value. Companies with a CX focus meet customer expectations, deliver engaging experiences, and empower their employees. As a result, they can recover from a recession faster, have better financial outcomes, and enable stronger innovations.

An article by HBR stated that CEOs are losing touch with frontline workers – this needs to change. Frontline staff are the ones who interact with customers, get their feedback, and possess a gold mine of information. Companies need to flip their organizational chart upside-down to support their frontline staff and eventually deliver value to customers.

“When you cut back on employee costs, operational costs, capital investments, or innovations, you’re actually becoming less competent. Companies that focus and invest in customer experience meet expectations, deliver engaging experiences, and recover from recession faster.”

|

Remain Positive in the Face of Economic Headwinds

It is not the strongest nor the fastest that survives, but the one that is most adaptable. These uncertain times present an adaptive challenge. Those who can adjust will succeed, while those who are too rigid and slow to change will fail. Businesses that show resilience during these bumpy times will grow rapidly, hold onto their margins, and retain their competitive advantage.